Editorial

Hello and welcome to the first tranfree of 2011.

I’ve always thought of macro-economics as a bit boring. But now the world economy seems to be in uncharted waters, watching what’s going on has become more interesting. It does look as though things are going badly wrong in many parts of the world. Although places where they still actually make things, or have natural resources seem to be doing OK (Germany, China, Brazil, OPEC nations).

Of course it’s impossible for everyone to be doing well all at the same time. It’s always been like that. But at the moment, it’s the “leading” Western nations’ turn to have its share of pain.

This leads me to think about how we as translators can limit our own exposure to risk. One of the biggest risks affecting freelance translators is the possibility of not being paid. So this month’s article is about credit control. You do have a credit control policy don’t you? If you don’t, I hope you soon will.

Do please feel free to come and comment on tranfree articles on my blog.

I hope you enjoy and benefit from tranfree

Alex Eames

tranfree editor, Author –

Business Success For Freelance Translators, and

Selling Your Professional Services on the Web

You Do Have a Credit Control Policy Don’t You?

By Alex Eames

Detestable debt

Any of you who have read my ebooks or been tranfree readers for some time, will know that I am not a big fan of debt. In fact I “debt-est” it (that pun will work better on the podcast edition.)  I don’t like the idea of being in debt and neither am I keen on other people owing me large sums of money.

I don’t like the idea of being in debt and neither am I keen on other people owing me large sums of money.

If you want proof that uncontrolled debt is a bad thing, look no further than the economies of most Western countries. The United States and many European countries, including the UK, are crippling themselves with massive national debt. This is effectively putting future generations into slavery – or it’s going to result in massive defaults and meltdown of the world financial system.

But some borrowing is helpful to keep things running. In the translation business, clients regularly borrow from freelancers. Instead of paying for work on delivery, payment is made at some future date (often 30 days). You extend your clients credit for a defined period of time (theoretically  ). In an ideal world, they would pay you immediately on delivery. With electronic banking systems, there’s no real reason apart from “established practice” why this couldn’t happen.

). In an ideal world, they would pay you immediately on delivery. With electronic banking systems, there’s no real reason apart from “established practice” why this couldn’t happen.

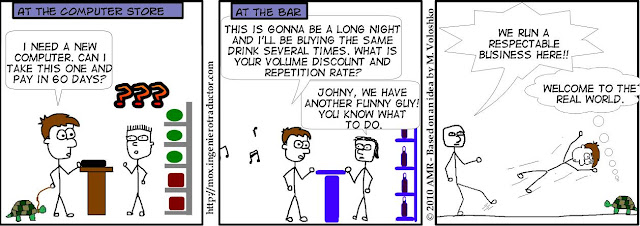

Walk out of any shop clutching the goods and shouting “I’ll pay you in 30 days” and see where that gets you.  You’ll end up in a prison cell pretty quickly.

You’ll end up in a prison cell pretty quickly.

(http://mox.ingenierotraductor.com/2010/11/welcome-to-real-world.html )

B2B is a bit different

Retail transactions are different from business to business (B2B) transactions. When we do retail jobs for people, we usually get paid on collection/delivery. B2B is different. Sad but true. But if you can negotiate immediate payment terms with any of your B2B clients, go for it. Then you won’t have any issues with wondering when/whether you are going to be paid.

But back here in the real world, most business to business customers don’t/won’t/can’t pay straight away. So they expect credit, which is yours to grant or deny – don’t forget that!

It’s not looking good out there (in general)

I’m keeping a keen eye on the world economy at the moment. What I see right now is rather unsettling. I see massive deficits, which are increasing already enormous debts, which can never be repaid. Countries in Europe are lining up (although several have not admitted it yet) to be bailed out by the European Central Bank, which is itself technically insolvent.

We’ve got Quantitative Easing – increasing the amount of money in circulation on both sides of the Atlantic. In the good old days it was called printing money. (Mind you, in the good old days, the QE2 was a ship.  ) Although, these days it may not involve the printing of physical cash, but creation of new money, as debt in the electronic financial system.

) Although, these days it may not involve the printing of physical cash, but creation of new money, as debt in the electronic financial system.

Anyone with basic economic education knows that when you increase the supply of money, if it’s not based on a physical asset – like gold, the result will be inflation. Tomorrow’s dollar, pound or euro will have less purchasing power than today’s. So what do governments do? They change from one measure of inflation to another. They fiddle the figures to make it look like this is not happening, whilst simultaneously making loud noises about deflationary influences. But those of us who notice the prices of things we buy every week, like food and petrol (gasoline) creeping up can see that, in reality, inflation is running at 6% already in the UK.

So what do governments do? They change from one measure of inflation to another. They fiddle the figures to make it look like this is not happening, whilst simultaneously making loud noises about deflationary influences. But those of us who notice the prices of things we buy every week, like food and petrol (gasoline) creeping up can see that, in reality, inflation is running at 6% already in the UK.

Now how did we get there? Oh yes. I’m not happy with what I see in the world economy right now. And this should make us a little bit wary. With massive debt and inflation, we can expect to see some high profile bankruptcies. I’m talking about all sorts of companies here, not just banks. The trouble is that companies are our clients. You can’t go bankrupt if you owe nothing. Conversely, if you have large debts that you can’t pay back, you are insolvent. Several large translation agency insolvencies have occurred in the past because their clients “went bust” leaving large unpaid bills. It can have a “knock-on” effect.

How to protect your business

So you need to protect yourself from the possibility of one of your clients going bankrupt because if they do, it will hit you in two ways.

- You won’t be getting any more work from them

- If they owe you money, you won’t get it (or if you do, it will be much less than they owe you)

So you need to have a credit control policy. That may sound like a “big business” thing, but you really should have one. You are just as much a business as they are!

If you set your clients a credit limit (e.g. $3000), once they have used it up, you won’t be able to accept more work from them until they have paid off some of their debt. This limits the amount you can lose in the event of non-payment (default).

You will have to set the exact figure depending on your relationship and past dealings with each client. There’s not much point setting a $3000 credit limit for a client you’ve worked with for 10 years, who sends you that much work every month and always pays on time.

Setting a credit limit

Set a sensible “standard” credit limit for new clients and adjust it up or down according to what you know about them. Here are a few ideas to get you started…

Able to verify contact info: +$500

No negative comments in Google search: +$500

No negative comments in blue board, payment practices, TC Hall of shame: +$500

Able to find translators who work with them and get paid: +$500

Known colleagues work with them: +$1,000

Well known and respected agency/company: $2,000

Allow this credit limit to grow, within reason, as you have successful business dealings with them on an ongoing basis. It would be reasonable to expect that a client you’ve worked with for years should be a good risk. But, do keep an ear to the ground in case you work with a client who may be getting into financial trouble.

Of course if you find any credible negative comments about a potential client, tread very carefully indeed. Ask for 50% payment in advance or extend them a very low credit limit.

Set an absolute limit too

Have an absolute top limit for ANY client (e.g. $10,000 – or two months output). Nobody ever gets more credit than this! No ifs nor buts. If I asked you to lend me $10,000 interest-free for 30 days what would you say? You’d probably invite me to go forth and multiply. If you allow clients to borrow this much from you, you may well take a large hit one day – and that would be tragic.

If you allow clients to borrow this much from you, you may well take a large hit one day – and that would be tragic.

Staged payments for large projects

Insist on staged payments or payments “on account” for enormous projects. This avoids the situation where you work 9 months on one project and never see a cent. Use credit limits to justify and enforce this. But agree it up-front.

“I will need monthly payments

and/or 50% in advance for this project”

Chase Tardy Payments

If you chase your clients to pay on time you will reduce your exposure to credit risk. The longer you leave it, the less chance you will be paid. Send a reminder immediately when payment becomes due and follow up regularly.

Diversify your client base

This may not always be possible, but try to ensure that no more than, say, 20-25% of your work comes from any one source. The more established you are, the easier this should be.

Don’t be a pushover

Above all, be firm, be professional and reasonable and stick to your guns. You don’t want to be the one at the wrong end of a defaulted £12,500 invoice (the highest unpaid debt to a freelance translator that I’ve ever heard of).

Alex Eames is the founder of translatortips.com, editor of tranfree and author of the eBooks…

Business Success for Freelance Translators

and

Selling Your Professional Services on the Web

If you liked this tranfree you will love the ebook

Business Success for Freelance Translators.

Come and check it out now.

ISSN 1470-3866

***End of issue 77***